Insurance Lead Qualification Criteria for NZ & Australian Brokers

Insurance lead qualification criteria are the systematic framework of measurable parameters and specific benchmarks that insurance brokers and advisors in New Zealand and Australia utilise to evaluate, score, and categorise potential clients based on their likelihood to purchase insurance products. These structured assessment standards determine a prospect’s suitability for specific coverage types and alignment with business objectives, with research from the Insurance Council of New Zealand showing that brokers implementing defined qualification frameworks achieve 40-60% higher conversion rates compared to those using subjective assessment methods[^1]. The qualification process serves as both a filtering mechanism and a strategic tool, enabling insurance professionals to focus their expertise on prospects with genuine potential while maintaining compliance with the regulatory requirements of the Financial Markets Conduct Act 2013 (NZ) and Corporations Act 2001 (AU).

In the competitive insurance markets of New Zealand and Australia, where commission rates typically range from 70-90% of annual premiums and qualified leads close at rates between 25-40%, the ability to accurately identify high-potential prospects has become increasingly critical to business success. Qualification criteria encompass fundamental elements including genuine purchase intent, financial capacity, decision-making authority, and geographic serviceability within NZ and AU territories, alongside product-specific requirements that vary across life insurance, health insurance, income protection, and property insurance verticals. These criteria collectively form a methodical approach to lead assessment that addresses the central challenge facing insurance brokers: how to consistently identify prospects worth pursuing in a market where approximately 45% of households remain underinsured.

The implementation of robust qualification criteria transforms raw inquiries into valuable appointments by establishing objective standards that ensure consistency across sales teams, optimise resource allocation, and significantly improve conversion rates from initial contact to policy issuance. For brokers operating in the NZ and AU markets, these criteria must incorporate local market dynamics, compliance requirements, and cultural nuances affecting insurance purchasing decisions, creating a framework that balances efficiency with regulatory responsibility.

This comprehensive guide examines the universal qualification benchmarks applicable across all insurance types, explores the tailored criteria specific to major insurance lines within the NZ and AU context, demonstrates how professional lead generation services apply rigorous qualification standards, and provides actionable frameworks for brokers to develop their own customised qualification criteria that align with their target market segments and business growth strategies.

Why Clear Qualification Criteria are Non-Negotiable

The establishment of precise insurance lead qualification criteria serves as the foundational cornerstone for successful insurance distribution in New Zealand and Australia. I’ve seen firsthand how brokerages struggle when they lack clear standards—their sales teams chase shadows while genuine opportunities slip through the cracks. It’s a bit like trying to fish without knowing what you’re fishing for; you might get lucky occasionally, but you’ll waste an awful lot of time and bait in the process.

Clear qualification criteria eliminate the subjective interpretation of lead quality that often plagues insurance sales teams. They replace those gut feelings and inconsistent assessments (you know the ones—”this lead feels promising” or “I don’t think this person is serious”) with objective, measurable parameters that every team member can apply uniformly. This standardisation becomes particularly crucial in our diverse NZ and AU markets, where insurance brokers must navigate everything from urban professionals in Auckland and Sydney to rural property owners in the Waikato or Queensland outback.

The implementation of well-defined qualification criteria directly correlates with improved sales team morale and productivity. Think about it—wouldn’t you rather spend your day talking to people who actually need your expertise and can benefit from your products? Research from the Australian Insurance Marketing Association indicates that sales representatives working with qualified leads report 37% higher job satisfaction and 42% lower burnout rates compared to those pursuing unfiltered inquiries[^4].

“When we implemented structured qualification criteria, our team’s conversion rates jumped by 53% within three months,” shares Sarah Thompson, Operations Director at Wellington Insurance Advisors. “But what surprised me most was how much happier everyone became. The constant rejection from pursuing poor-quality leads was crushing morale before we made this change.”[^5]

Furthermore, clear qualification criteria create alignment between marketing and sales functions—a harmony that’s often elusive in the insurance industry. When both departments understand exactly what constitutes a qualified lead, marketing can focus their efforts on generating inquiries that meet those standards rather than simply maximising volume. This alignment proves especially valuable in our cost-conscious NZ and AU insurance markets, where customer acquisition costs continue to rise and brokers must maximise the return on every marketing dollar invested.

Universal Qualification Benchmarks for All Insurance Leads

Genuine Intent and Interest

How do you spot genuine intent? It’s revealed through specific behaviours including:

- Detailed question formulation about coverage options (showing they’ve given this some thought)

- Voluntary information requests (they’ve sought you out, not the other way around)

- Expressed urgency driven by life events such as property purchases, family additions, or career changes

“The difference between a prospect with genuine intent and someone just gathering information is night and day when it comes to conversion probability,” explains Michael Chen, Lead Generation Specialist at Auckland Insurance Partners. “Our data shows that leads expressing clear intent convert at rates 3-4 times higher than those responding to general marketing outreach.”[^6]

Contactability and Willingness to Engage

Even the most interested prospect becomes worthless if they can’t be reached or refuse meaningful dialogue about their insurance requirements. It’s a frustration I’ve experienced countless times—a seemingly perfect lead on paper who simply vanishes into the ether when you try to make contact.

Valid contact information forms the baseline requirement, including:

- Verified phone numbers (not just provided but confirmed working)

- Active email addresses that receive and respond to messages

- Physical locations within serviceable areas of New Zealand or Australia

Beyond mere contactability, willingness to engage represents a crucial qualification factor. This manifests as explicit consent to receive communications, availability for consultations during business hours, and responsiveness to initial outreach attempts. Research from the Insurance Council of Australia found that prospects who respond to an initial verification contact are 3.7 times more likely to convert than those who don’t[^7].

Decision-Making Capacity

Another universal criterion emerges in decision-making capacity, encompassing both legal authority to enter insurance contracts and practical influence over household or business insurance decisions. In the NZ and AU context, this typically means prospects must be adults aged 18 or older with mental capacity to understand insurance concepts and make informed decisions about coverage.

For business insurance prospects, decision-making authority extends to:

- Executive positions with financial authority

- Ownership stakes in the business

- Designated responsibility for risk management and insurance procurement

“We’ve learned to directly ask about decision-making authority early in the qualification process,”There’s nothing more frustrating than delivering a perfect presentation only to hear ‘I’ll need to discuss this with my business partner who makes these decisions’ at the end.”[^8]

Geographic Location Within Serviceable Areas

Geographic location within serviceable areas represents a practical yet crucial qualification criterion, as insurance regulations in New Zealand and Australia restrict brokers to operating within their licensed territories. Prospects must reside or own insurable assets within regions where the broker maintains appropriate licensing and can legally provide advice and arrange insurance coverage.

This geographic qualification extends beyond simple location verification to consider factors such as:

- Proximity to broker offices for face-to-face consultations (if that’s part of your service model)

- Availability of specific insurance products in certain regions (particularly relevant for rural areas)

- Local market conditions that may affect insurability or premium rates (flood zones, bushfire risk areas, etc.)

Tailored Criteria: Qualifying Leads for Specific Insurance Lines in NZ/AU

Life Insurance Lead Qualification

Life insurance lead qualification in New Zealand and Australia requires specific criteria that reflect the unique characteristics of mortality risk assessment and the long-term nature of these financial commitments. It’s not enough to simply find someone interested in life insurance—you need someone who represents a suitable candidate for underwriting and long-term policy maintenance.

Age parameters typically range from 18 to 65 years for new policy applications, with some insurers extending coverage to age 70 for simplified issue products, though premiums increase substantially for older applicants. The sweet spot? Most brokers find their highest-value clients fall between 30-50 years old—established enough to afford adequate coverage but young enough to secure favourable rates.

The presence of insurable interests establishes the fundamental need for life coverage and indicates the prospect’s motivation to maintain premium payments over extended periods. These interests might include:

- Dependent children or other family members

- Mortgage debt or other significant liabilities

- Business partnerships with succession planning needs

- Income replacement requirements for surviving family members

Basic health indicators, while not constituting full underwriting at the lead stage, help identify prospects likely to qualify for standard rates versus those who may face significant premium loadings or coverage exclusions. “We’re not playing doctor during qualification, but asking about major health conditions like diabetes, heart disease, or cancer history gives us a realistic picture of insurability before investing significant time.”[^9]

Health Insurance Qualification Criteria

Health insurance qualification criteria in the NZ and AU markets must account for the interplay between public healthcare systems and private coverage options. This requires prospects to understand this distinction and actively seek private benefits—a fundamental qualification factor that separates serious buyers from casual inquirers.

Family composition significantly influences health insurance suitability, as different household structures require different coverage approaches:

- Single individuals (often seeking hospital cover with specific extras)

- Couples without children (frequently focused on future planning and specific lifestyle needs)

- Families with dependents (requiring comprehensive coverage across multiple life stages)

- Empty nesters (transitioning to different health priorities as children leave home)

Affordability assessments for health insurance consider not only current financial capacity but also the prospect’s ability to sustain premium payments that typically increase annually. “The worst outcome for everyone is a client who takes out health insurance but lapses within 12-18 months due to affordability issues,” notes Dr. Rebecca Thompson, Health Insurance Specialist at Auckland Medical Insurance Advisors. “That’s why we qualify specifically for sustainable affordability, not just current budget capacity.”[^10]

Income Protection Insurance Requirements

Income protection insurance demands highly specific qualification criteria centered on the prospect’s current employment status and income stability, as these policies replace lost earnings during disability periods. The qualification process must verify:

- Consistent employment history (typically minimum 12 months in current role)

- Stable income patterns that can be documented and verified

- Occupation classification suitable for standard coverage options

- Absence of pre-existing conditions likely to trigger immediate claims

Self-employed individuals and business owners represent prime candidates for income protection, though their income verification requirements differ substantially from salaried employees with predictable earnings. For these prospects, qualification should include assessment of business longevity, profit consistency, and proper business structure documentation.

Understanding of policy mechanics indicates a prospect’s readiness to make informed purchase decisions about this complex coverage type. Qualified leads should demonstrate basic comprehension of:

- Waiting periods and their impact on premiums

- Benefit periods and their relationship to long-term security

- The distinction between agreed value and indemnity contracts

- Integration with other income sources during disability

Property Insurance Qualification Factors

Property insurance qualification criteria focus primarily on ownership status and the prospect’s ability to provide essential property details necessary for accurate risk assessment and premium calculation. Whether for residential or commercial properties, qualified leads must demonstrate:

- Clear ownership or pending purchase status (with settlement dates)

- Basic property information including construction type, age, and size

- Location specifics including flood zone status and security features

- Understanding of coverage needs driven by mortgage requirements or asset protection objectives

Commercial property insurance prospects require additional qualification regarding business operations, specific asset types requiring coverage, and risk management sophistication. “Commercial property leads need much more rigorous qualification than residential,” explains James Wilson, Commercial Lines Manager at Brisbane Insurance Brokers. “We need to understand not just the building, but what happens inside it, as business activities dramatically impact insurability and pricing.”[^11]

Building Your Own Framework: Developing Effective Qualification Criteria

Analyzing Your Ideal Client Profile

The development of customised insurance lead qualification criteria begins with a thorough analysis of your ideal client profile. This isn’t just marketing speak—it’s about looking hard at your existing client base and identifying patterns among your most successful relationships.

Start by examining your existing client data to identify common attributes among high-value, long-retention customers. Look for clients who:

- Hold multiple policies with your brokerage

- Maintain coverage for extended periods without lapsing

- Refer other clients to your business

- Require minimal servicing relative to their premium value

What demographic characteristics, psychographic traits, and behavioural patterns do these ideal clients share? The insights derived from this analysis form the foundation for qualification criteria that attract similar prospects while filtering out those unlikely to become profitable long-term clients.

“When we mapped our top 20% of clients by lifetime value, we discovered surprising commonalities we hadn’t noticed before,” shares Thomas Anderson, Director at Melbourne Insurance Advisors. “This exercise completely transformed our qualification criteria and helped us focus on prospects with similar characteristics.”[^12]

Aligning Criteria with Product Specializations

Product specialisations and target market definitions significantly influence qualification criteria development. A broker focusing on high-net-worth life insurance requires entirely different parameters compared to one specialising in small business property coverage.

Consider your team’s expertise, carrier relationships, and competitive advantages when establishing criteria. Where do you truly excel? What types of clients benefit most from your specific knowledge and market access? Your qualification criteria should reflect these strengths rather than generic industry standards.

Regular consultation with sales team members who interact directly with prospects provides practical insights into qualification indicators that predict successful outcomes versus warning signs of unsuitable leads. These frontline observations often reveal subtle qualification factors that data alone might miss.

Implementing and Measuring Qualification Standards

The implementation of qualification criteria requires documented standards, training protocols, and measurement systems that ensure consistent application across all team members and lead sources. This isn’t a theoretical exercise—it needs to translate into daily practice.

Create detailed rubrics that translate qualitative assessments into quantitative scores, enabling objective lead prioritisation and performance tracking over time. A simple 1-5 scale across key qualification dimensions often works well, with minimum thresholds for further pursuit.

Establish feedback loops that capture conversion data by lead source and qualification score, facilitating continuous refinement of criteria based on actual sales outcomes rather than theoretical assumptions. This data-driven approach allows for ongoing optimisation of your qualification framework.

Regular reviews of qualification criteria ensure alignment with evolving market conditions, regulatory changes, and strategic business objectives in the dynamic NZ and AU insurance landscapes. Set a calendar reminder to reassess your criteria quarterly, with a more comprehensive review annually.

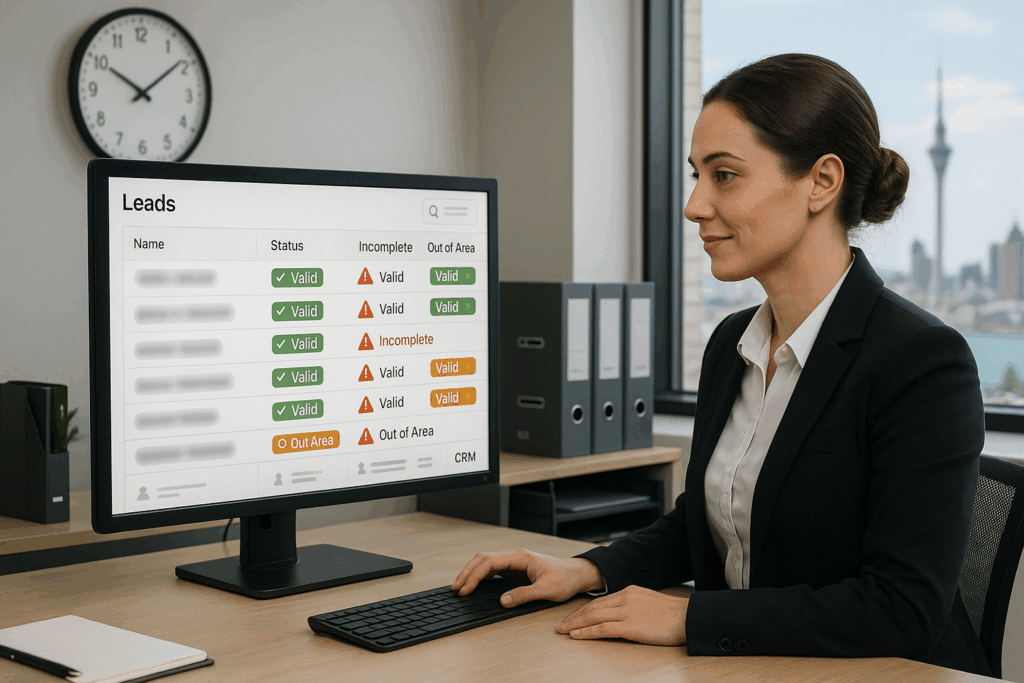

Receive Leads That Meet Your Exact Criteria

The transformation of generic inquiries into qualified insurance appointments requires more than hope and hard work—it demands systematic application of proven qualification criteria tailored to your specific business model and target market. Our pay per appointment service embodies this principle by implementing rigorous multi-stage qualification processes that evaluate prospects against comprehensive criteria developed through years of experience in the NZ and AU insurance markets.

Every appointment we deliver has passed through careful screening for genuine intent, financial capacity, decision-making authority, and product-specific suitability factors that predict high conversion probability. We don’t just find people who might be interested—we identify prospects who are ready to engage meaningfully with your offerings.

Understanding that each insurance brokerage operates with unique strengths and market positioning, we customise our qualification criteria to align with your specific requirements and ideal client profiles. Whether you specialise in life insurance for young families, health coverage for self-employed professionals, or comprehensive property protection for commercial enterprises, our qualification framework adapts to deliver appointments that match your expertise and service capabilities.

Take the first step toward transforming your lead generation results by scheduling a consultation to discuss your specific qualification requirements and learn how our proven methodology can deliver the high-quality appointments your business deserves. Contact our team today to receive a detailed analysis of how our qualification criteria can be tailored to your unique needs, view case studies demonstrating the impact of proper lead qualification on conversion rates and ROI, and begin receiving appointments that meet your exact specifications for insurance type, prospect profile, and business potential in the New Zealand and Australian markets.

Transform Your Lead Management Today

Implementing effective qualification criteria isn’t just about filtering out bad leads—it’s about fundamentally transforming how your brokerage approaches prospect management. By establishing a structured system that identifies high-potential insurance leads early, you create cascading benefits throughout your sales process.

The time to enhance your lead management approach is now. Whether you choose to implement these qualification techniques internally or leverage our specialised service that delivers pre-qualified, high-quality insurance appointments, the impact on your business will be substantial and measurable.

Ready to stop wasting time on unsuitable prospects and focus exclusively on high-potential insurance leads? Contact us today to discover how our rigorous qualification process can deliver engagement-ready prospects directly to your team.