Premium Pay Per Appointment Insurance Lead Generation Services

Transform Your Insurance Business with Qualified, Exclusive Prospects

Let’s face it – are you completely fed up with burning through valuable time and resources on those low-quality insurance leads that rarely convert? I know I was. In today’s cutthroat insurance landscape across New Zealand and Australia, the difference between barely surviving and absolutely thriving often boils down to one thing: the quality of your prospect pipeline.

Here’s something to chew on: with over $4 billion in annual premiums floating around the New Zealand market alone and roughly 45% of households still walking around underinsured, the opportunity for insurance brokers is massive – but only if you can connect with the right prospects without wasting half your life doing it.

According to a 2023 report by the Financial Services Council of New Zealand (FSCNZ), over $4.2 billion in annual life insurance premiums are generated domestically, yet approximately 45% of New Zealand households remain underinsured (FSCNZ, 2023 Insurance Market Report). Similarly, ASIC in Australia reports significant insurance gaps, particularly in income protection and life insurance sectors.

I’ve spent years perfecting what I believe is a fundamentally better approach. Backed by insights from IBANZ (Insurance Brokers Association of New Zealand) and industry best practices outlined by APRA (Australian Prudential Regulation Authority), our specialized Pay Per Appointment lead generation service delivers something radically different: pre-qualified, high-intent prospects who actually want to discuss insurance solutions with you. Unlike those traditional lead generation services (you know, the ones that sell you a list and wish you good luck), you only pay for scheduled appointments with qualified prospects who match your exact criteria — fully compliant with Privacy Act 2020 (NZ) and Australian Privacy Principles (APPs).

This risk-free, results-based approach ensures:

- You meet only with genuinely interested prospects (no more time-wasting tire-kickers)

- Every lead is call-qualified by our local team (real humans, not bots)

- All appointments are exclusive and never shared with competitors (your prospects, period)

- Comprehensive coverage across all insurance types

- Specialized knowledge of New Zealand and Australian markets

The Pay Per Appointment Advantage: A Superior Model

Moving Beyond Traditional Lead Generation

Let’s call it what it is – the traditional lead generation model is fundamentally broken for insurance brokers. Paying for lists of names and contact details—many of whom have zero genuine interest or aren’t financially qualified—creates enormous waste in both your marketing budget and your precious time.

Our Pay Per Appointment model represents a complete paradigm shift in how insurance brokers acquire new clients:

| Traditional Lead Generation | Pay Per Appointment Model |

|---|---|

| Pay for contact information | Pay only for scheduled meetings |

| 3-5% average conversion rate | 25-40% average conversion rate |

| Significant time spent qualifying | Prospects pre-qualified before you meet |

| High risk of wasted spend | No-show replacement guarantee |

| Unknown return on investment | Predictable acquisition costs |

| Mixed quality leads | Consistently high-quality prospects |

The Financial Advantage: ROI Calculation

I remember working with an insurance broker in Auckland – let’s call him David – who was skeptical about switching from his traditional lead buying approach. After three months of tracking his results side by side with our system, the numbers told a compelling story:

Traditional Lead Generation: benchmarks from IBISWorld 2023 Insurance Brokerage Industry Report

- 100 leads purchased at $30 each = $3,000

- Time spent qualifying and contacting (25 hours at $75/hr) = $1,875

- Total cost: $4,875

- Typical conversion: 4 new clients

- Cost per acquisition: $1,218.75

Our Pay Per Appointment Model:

- 10 qualified appointments at $250 each = $2,500

- Minimal preparation time (5 hours at $75/hr) = $375

- Total cost: $2,875

- Typical conversion: 4 new clients

- Cost per acquisition: $718.75

The result? A whopping 41% reduction in acquisition costs while completely eliminating the soul-crushing frustration of wasted time on unqualified prospects. “I wish I’d done this years ago,” David told me over coffee last month. “I’m working less and earning more.”

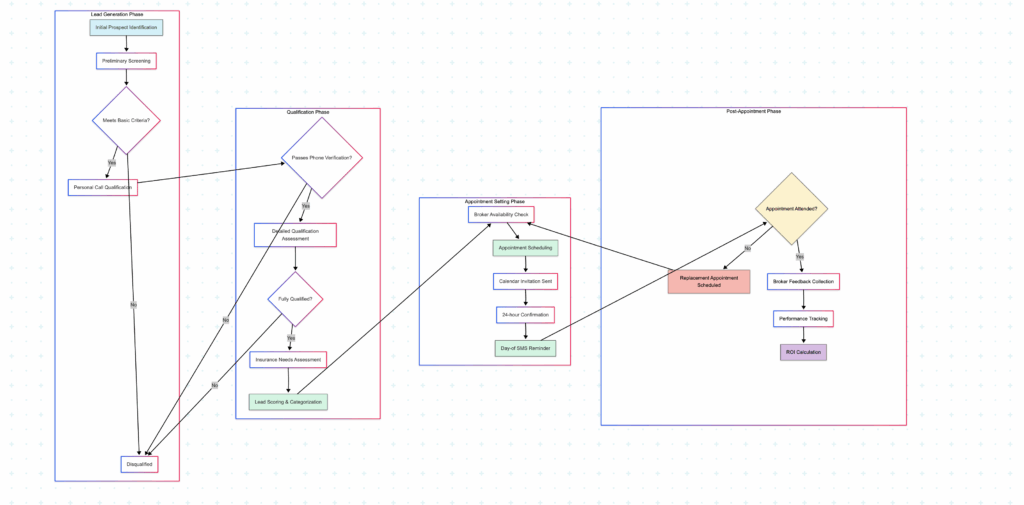

Our Lead Qualification Process: Quality Above All

Look, anyone can promise you “qualified leads” – but what does that actually mean in practice? Our rigorous qualification process ensures you only meet with prospects who are genuinely interested in your insurance solutions and meet your specific criteria.

1. Strategic Lead Generation

We don’t just throw darts in the dark. We utilize a multi-channel approach tailored specifically to insurance products, focusing on high-intent channels where prospects are actively seeking insurance solutions. This includes specialized insurance comparison platforms, targeted digital campaigns, and professional networks.

2. Initial Screening

Each potential lead undergoes preliminary screening against your specific criteria, including:

- Geographic location within your target area

- Financial qualification thresholds

- Insurance type and coverage needs

- Decision-making authority

- Timeframe for decision

3. Personal Call Qualification

Here’s where we really separate ourselves from the pack. What truly sets us apart is our dedicated local call team that personally speaks with every potential prospect. During these conversations, our trained specialists:

- Verify all personal information

- Confirm genuine interest in discussing insurance options

- Assess awareness of typical premium ranges

- Identify specific insurance needs and concerns

- Gauge readiness to engage with a broker

I’ve listened to hundreds of these qualification calls, and I’m constantly amazed at how much valuable information our team uncovers – information that helps you walk into every appointment prepared to address that prospect’s specific situation.

4. Appointment Scheduling

Only prospects who successfully pass all qualification stages are offered the opportunity to schedule an appointment with you. We handle all scheduling aspects, including:

- Alignment with your availability

- Calendar integration and automatic reminders

- Pre-appointment confirmation communications

- Rescheduling assistance when needed

5. Ongoing Quality Assurance

We’re obsessive about quality – frankly, our reputation depends on it. We continually monitor quality metrics, including show rates, feedback from brokers, and conversion data to refine our qualification criteria and maintain our industry-leading quality standards.

Insurance Types We Cover: Comprehensive Expertise

Our specialized lead generation service delivers qualified appointments across all major insurance categories in New Zealand and Australia. We understand the unique selling points, common objections, and qualifying criteria for each insurance type.

Life Insurance

With approximately 40% of New Zealand households lacking adequate life insurance coverage (FSCNZ Life Insurance Report, 2023), this market presents substantial opportunity. Our life insurance appointments focus on:

- Family protection needs

- Mortgage and debt coverage requirements

- Estate planning considerations

- Business succession planning

Our life insurance appointments achieve an average close rate of 32%, with typical first-year commissions of $1,200-$2,500.

Health Insurance

As public healthcare systems face increasing pressure, private health insurance has become essential for many families and individuals. Our health insurance appointments focus on:

- Gap coverage needs

- Specialist access concerns

- Private hospital options

- Pre-existing condition considerations

Health insurance appointments show an average close rate of 28%, with typical annual commissions of $800-$1,500.

Income Protection

With 70% of working adults lacking adequate income protection coverage, this market represents a significant opportunity. Our income protection appointments focus on:

- Occupation-specific risks

- Current financial obligations

- Self-employment considerations

- Existing coverage gaps

Income protection appointments achieve an average close rate of 34%, with typical annual commissions of $1,300-$2,200.

Property & Asset Insurance

Our property and asset insurance appointments cover home, contents, vehicle, and other asset protection needs. These appointments focus on:

- Comprehensive coverage evaluation

- Risk assessment and mitigation

- Bundling opportunities

- Premium optimization strategies

Property insurance appointments show an average close rate of 38%, with typical annual commissions of $600-$1,200.

Geographic Coverage: Local Expertise Matters

I learned this lesson the hard way years ago when I tried to use a one-size-fits-all approach across different regions. Understanding the unique insurance landscape in different regions across New Zealand and Australia is absolutely crucial for effective lead generation. Our team brings specialized local knowledge that ensures prospects are properly qualified according to regional factors.

New Zealand Coverage

We provide comprehensive coverage across all major New Zealand regions, including:

- Auckland and the Upper North Island

- Wellington and the Lower North Island

- Christchurch and Canterbury

- Otago and Southland

Our New Zealand team understands the unique factors affecting insurance decisions in different regions, from earthquake considerations in Wellington and Christchurch to flood risks in various areas and regional variations in healthcare access.

Australia Coverage

Our Australian operations cover all major metropolitan and regional areas:

- Sydney and New South Wales

- Melbourne and Victoria

- Brisbane and Queensland

- Perth and Western Australia

- Adelaide and South Australia

We account for state-specific regulations, natural disaster considerations, and regional economic factors that influence insurance buying decisions across different Australian territories.

How It Works: Simple, Transparent, Effective

Getting started with our Pay Per Appointment service is straightforward, with a clear process designed to deliver results quickly while maintaining quality.

1. Initial Consultation

We begin with a complimentary strategy session to understand:

- Your specific insurance products and services

- Target client profiles and qualification criteria

- Geographic coverage areas

- Volume requirements and capacity

- Performance goals and metrics

2. Customized Program Setup

Based on your requirements, we develop a tailored appointment generation program:

- Custom qualification script development

- Calendar integration and scheduling setup

- Reporting dashboard configuration

- Quality control parameters establishment

- Performance metric alignment

3. Appointment Delivery

Once your program is active, you’ll begin receiving qualified appointments:

- Appointments delivered directly to your calendar

- Comprehensive prospect profiles provided before each meeting

- 24-hour advance notifications and confirmations

- Same-day summaries of appointment outcomes

- Weekly performance reviews and optimizations

4. Ongoing Optimization

We continually refine your program based on performance data:

- Monthly performance analysis meetings

- Qualification criteria refinements

- Show rate optimization strategies

- Conversion rate improvement suggestions

- Scaling recommendations as appropriate

Typically, brokers begin receiving their first qualified appointments within 7-14 days of program launch, with optimization bringing peak performance by the 30-45 day mark.

Testimonials and Results: Real Brokers, Real Success

Our Pay Per Appointment service has transformed the growth trajectory for insurance brokers across New Zealand and Australia. Here are just a few success stories:

“After years of wasting money on leads that rarely converted, switching to this appointment model has been revolutionary. I’m now seeing 4-5 qualified prospects each week, converting 30-40% into clients, and my acquisition cost has dropped by 35%. The quality difference is night and day.”

— Michael T., Life Insurance Broker, Auckland

“As a health insurance specialist, finding qualified prospects was always challenging. Now I receive 3-4 appointments weekly with people who genuinely understand the value of private health coverage and have the means to proceed. My closing rate has increased from 18% to 32% in just three months.”

— Sarah L., Health Insurance Advisor, Sydney

“Working in rural Australia presented unique challenges for finding new clients. This Pay Per Appointment service has delivered consistent, quality appointments with the exact client profile I specified. My practice has grown 47% year-over-year since implementing this system.”

— James B., Multi-line Insurance Broker, Regional Victoria

The consistent thread across our client success stories is clear: higher quality appointments lead to significantly improved conversion rates, reduced acquisition costs, and accelerated business growth.

I still remember when Michael (quoted above) called me after his first month. “Greg,” he said, “I’ve spent more time with my family in the last four weeks than I did in the previous three months combined – and I’m making more money. This isn’t just a business improvement; it’s a life improvement.”

Start Growing Your Insurance Business Today

The difference between struggling and thriving as an insurance broker often comes down to the quality of your prospect pipeline. Our Pay Per Appointment model eliminates the risk, wasted time, and frustration traditionally associated with lead generation.

Why Choose Our Pay Per Appointment Service?

- Risk-Free Results: Pay only for qualified appointments

- Quality Guarantee: All prospects personally call-verified

- Exclusivity: Leads never shared with competitors

- Comprehensive Coverage: All insurance types and regions

- Local Expertise: Specialized knowledge of NZ/AU markets

- Proven ROI: Documented success across insurance categories

Financial Services Council of New Zealand. (2023). New Zealand Insurance Market Annual Report. Retrieved from https://www.fsc.org.nz

Insurance Brokers Association of New Zealand. (n.d.). Membership and Industry Standards. Retrieved from https://www.ibanz.co.nz

Australian Securities and Investments Commission. (2023). Consumer Insurance Rights and Obligations. Retrieved from https://asic.gov.au

Australian Prudential Regulation Authority. (2023). APRA Annual Insurance Overview. Retrieved from https://www.apra.gov.au

Insurance Council of Australia. (2023). Underinsurance in Australia Report. Retrieved from https://insurancecouncil.com.au

IBISWorld. (2023). Insurance Brokerage in Australia and New Zealand Industry Reports. Retrieved from https://www.ibisworld.com

Office of the Privacy Commissioner. (2020). Privacy Act 2020. Retrieved from https://www.privacy.org.nz

Office of the Australian Information Commissioner. (n.d.). Australian Privacy Principles (APPs). Retrieved from https://www.oaic.gov.au