Health Insurance Leads for Brokers in New Zealand & Australia

Health insurance leads are defined as prospective clients who have expressed interest in purchasing private health coverage and have provided their contact information for follow-up by insurance professionals. In the context of New Zealand and Australia, these leads represent approximately 15-20% of the total insurance inquiry volume, with an estimated 45% of households across both countries remaining underinsured for private health coverage according to industry data. The qualification process for health insurance leads involves a systematic evaluation of prospect intent, financial capacity, and specific coverage needs to determine their readiness to engage with insurance brokers.

The acquisition of high-quality health insurance leads presents a significant challenge for brokers in today’s competitive marketplace, where 54.9% of Australians have extras cover and 45.2% have hospital cover as of 2025. This challenge is compounded by the distinct healthcare environments in both New Zealand, with its market size of $2.6 billion in 2024 (a 17.26% increase from 2023), and Australia, where health insurance premiums increased by an average of 3.73% in 2025. Our pay per appointment model addresses these challenges by delivering pre-qualified, high-intent health insurance appointments with prospects who are actively seeking private coverage, enabling brokers to focus on their core advisory function rather than prospecting activities.

The private health insurance landscape across New Zealand and Australia offers both opportunities and challenges, with the New Zealand sector projected to reach USD 671.64 million by 2029, growing at a CAGR of 1.1%. Understanding why quality leads are crucial involves recognizing that qualified prospects convert at rates 25-40% higher than unqualified leads (which typically convert below 5%), significantly improving return on investment. Our proven process for generating these qualified appointments employs a multi-channel approach with rigorous verification protocols that ensure prospect commitment. This process directly supports the pay per appointment model’s advantages, which include zero financial risk, predictable acquisition costs, and scalable business growth.

For brokers specialising in specific market segments, our service can target prospects interested in hospital cover, extras/ancillary coverage, combined policies, or leads segmented by demographic factors and specific interests. This targeted approach ensures alignment between broker expertise and prospect needs, further enhancing conversion potential. By partnering with our specialised lead generation service, brokers gain access to a proven pathway for sustainable business growth without compromising on prospect quality or diverting resources from their core advisory functions.

The following sections will explore each of these aspects in detail, providing a comprehensive understanding of how our specialized health insurance lead generation service can transform your business efficiency and growth trajectory in the competitive New Zealand and Australian markets.

Navigating the Private Health Insurance Market in NZ & Australia

Let’s face it – the private health insurance landscape in New Zealand and Australia is a complex beast. I’ve spent years watching these markets evolve, and they continue to present fascinating opportunities alongside some pretty significant challenges for brokers seeking quality leads.

In Australia, nearly 55% of the population has extras cover and about 45% has hospital cover as of 2025. That’s a massive potential market! Meanwhile, New Zealand’s private health sector continues its steady climb, reaching a market size of $2.6 billion in 2024 – a whopping 17.26% jump from the previous year. Not too shabby, right?

What drives consumers in both countries? From what I’ve seen, it boils down to three key factors: rising healthcare costs in the public system, those frustratingly long wait times for elective procedures, and the desire for greater provider choice. People aren’t just buying insurance – they’re buying peace of mind and control over their healthcare journey.

The aging population has dramatically shifted the playing field too. More seniors are seeking private coverage for specialized care and – you guessed it – shorter wait times for procedures they don’t want to postpone. This demographic shift creates a perfect opportunity for brokers who understand how to connect with this audience.

Here’s where things get interesting though… While these markets share similarities, they operate under distinctly different systems. Australia’s private health insurance exists alongside Medicare, with coverage organized in those familiar tiers (Basic, Bronze, Silver, and Gold) plus Extras coverage. Many Australians are motivated by avoiding the Medicare Levy Surcharge or that dreaded Lifetime Health Cover loading that increases premiums by 2% for each year they delay getting coverage after age 31.

New Zealand, on the other hand, features a public health service with private insurance as a supplement, without the regulatory incentives found across the Tasman. Southern Cross dominates as the largest provider, followed by other key players including nib, AIA, and UniMed. The market has been on a tear, recording an annualized growth rate of 9.4% over the five years through 2023-24.

Understanding these nuances isn’t just helpful – it’s absolutely essential for connecting with the right prospects at the right time with the right message.

Navigating the Private Health Insurance Market in NZ & Australia

Let’s face it – the private health insurance landscape in New Zealand and Australia is a complex beast. I’ve spent years watching these markets evolve, and they continue to present fascinating opportunities alongside some pretty significant challenges for brokers seeking quality leads.

In Australia, nearly 55% of the population has extras cover and about 45% has hospital cover as of 2025. That’s a massive potential market! Meanwhile, New Zealand’s private health sector continues its steady climb, reaching a market size of $2.6 billion in 2024 – a whopping 17.26% jump from the previous year. Not too shabby, right?

What drives consumers in both countries? From what I’ve seen, it boils down to three key factors: rising healthcare costs in the public system, those frustratingly long wait times for elective procedures, and the desire for greater provider choice. People aren’t just buying insurance – they’re buying peace of mind and control over their healthcare journey.

The aging population has dramatically shifted the playing field too. More seniors are seeking private coverage for specialized care and – you guessed it – shorter wait times for procedures they don’t want to postpone. This demographic shift creates a perfect opportunity for brokers who understand how to connect with this audience.

Here’s where things get interesting though… While these markets share similarities, they operate under distinctly different systems. Australia’s private health insurance exists alongside Medicare, with coverage organized in those familiar tiers (Basic, Bronze, Silver, and Gold) plus Extras coverage. Many Australians are motivated by avoiding the Medicare Levy Surcharge or that dreaded Lifetime Health Cover loading that increases premiums by 2% for each year they delay getting coverage after age 31.

New Zealand, on the other hand, features a public health service with private insurance as a supplement, without the regulatory incentives found across the Tasman. Southern Cross dominates as the largest provider, followed by other key players including nib, AIA, and UniMed. The market has been on a tear, recording an annualized growth rate of 9.4% over the five years through 2023-24.

Understanding these nuances isn’t just helpful – it’s absolutely essential for connecting with the right prospects at the right time with the right message.

The Critical Role of Quality Leads in Health Insurance Sales

Have you ever spent hours chasing leads that go absolutely nowhere? If you’re nodding your head right now, you’re not alone. Finding genuinely interested prospects is perhaps the greatest challenge facing health insurance brokers across New Zealand and Australia today.

The truth about generic leads is painful – they drain your resources faster than a leaky faucet. Industry research shows that unqualified prospects typically convert at rates below 5%. Compare that to properly qualified appointments, which convert at 25-40%, and you’ll see why the difference directly impacts your bottom line. The cost of pursuing low-quality leads compounds rapidly, eating away at your profitability and, frankly, your sanity.

So what makes a high-quality health insurance lead stand out from the crowd? I’ve found they consistently demonstrate five critical characteristics:

- Genuine Interest: They’re actively seeking information about private coverage options – not just casually browsing out of curiosity.

- Financial Capability: They have the income threshold necessary to maintain premium payments (no point pursuing someone who simply can’t afford the coverage).

- Specific Need Awareness: They understand their healthcare requirements and how private insurance addresses these needs.

- Decision Readiness: They’re prepared to make coverage decisions within a defined timeframe – not six months down the road.

- Demographic Fit: They match the target profile for specific types of health insurance products you offer.

Health insurance decisions involve deeply personal considerations – existing medical conditions, family health history, specific coverage requirements. This makes the qualification process substantially different from other insurance verticals. Add to this the complexity of health insurance products themselves, and you need prospects with either higher baseline knowledge or a genuine willingness to learn about coverage options.

I’ve seen too many brokers waste countless hours on prospects who were never going to convert. It’s not just the time spent in meetings – it’s the preparation beforehand, the follow-up afterward, and the opportunity cost of not focusing on better prospects. That’s time and money you’ll never get back.

Our Proven Method for Generating Qualified Health Insurance Appointments

So how exactly do we deliver those gold-standard health insurance leads? Our approach isn’t revolutionary – it’s evolutionary, built on years of testing and refinement specifically for the health insurance sector in New Zealand and Australia.

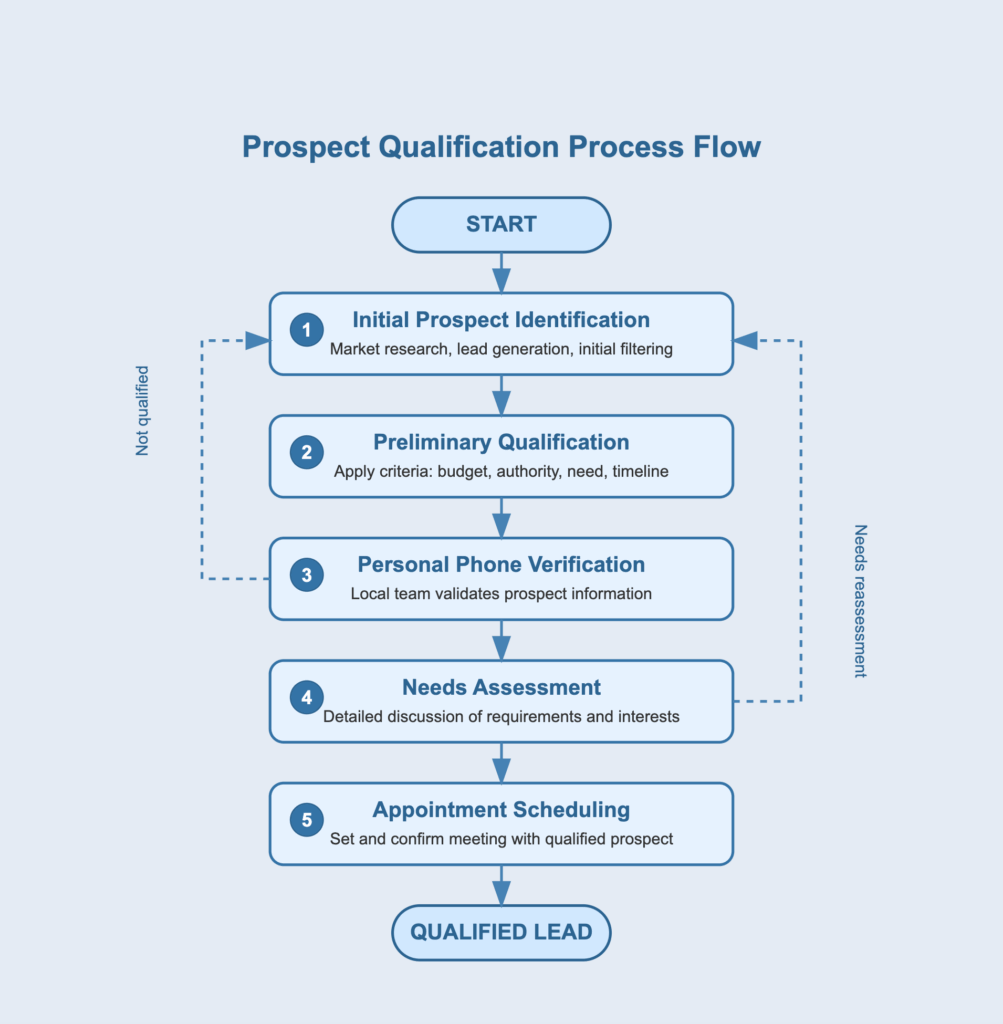

We employ a rigorous multi-step qualification process that looks something like this:

1. Initial Prospect Identification

We cast a wide but strategic net using targeted multi-channel strategies to identify potential health insurance buyers. This includes digital marketing (those Facebook ads you’ve probably seen), content marketing (yes, people actually read those long-form articles about healthcare), and strategic partnerships with healthcare providers who can refer patients interested in private coverage.

2. Preliminary Qualification

Before we make any contact, prospects undergo initial screening based on demographic data, online behavior patterns, and expressed interest in private health coverage. This helps us filter out the tire-kickers from those with genuine intent.

3. Personal Call Verification

This is where things get serious. Our local team conducts thorough telephone interviews to assess genuine interest, understanding of private health insurance benefits, and readiness to meet with a broker. You’d be amazed how many prospects drop off at this stage – which is exactly the point! Better they drop off here than waste your valuable time.

4. Health Needs Assessment

We delve into specific requirements, including preferred coverage types (hospital, extras, combined), family status, and any particular health concerns driving their interest. This helps us match them with the right broker specializing in their specific needs.

5. Appointment Scheduling

Only after confirming all qualification criteria do we schedule appointments with prospects, ensuring they understand the purpose and value of meeting with a health insurance professional. By this point, they’re primed and ready for a productive conversation.

Throughout this entire process, we adhere to strict privacy regulations governing health information in both New Zealand and Australia. Our verification teams are trained in compliance with health privacy standards – this isn’t just ethical, it’s essential for operating in this space.

What makes our lead qualification process particularly effective for health insurance is our focus on verifying several key elements:

- Public vs. Private System Understanding: We ensure prospects comprehend the relationship between public healthcare and private coverage – no point in meeting someone who thinks private insurance replaces rather than supplements the public system.

- Waiting Period Awareness: We confirm prospects understand policy waiting periods for certain treatments – a common stumbling block in the sales process.

- Premium/Coverage Balance: We assess prospects’ expectations regarding premium costs relative to coverage benefits – unrealistic expectations lead to wasted appointments.

- Claims Process Knowledge: We gauge prospects’ understanding of how policy claims work – the more they know upfront, the smoother your sales conversation will be.

Boost Your Success with Pay Per Appointment Health Insurance Leads

Let’s talk numbers – because at the end of the day, that’s what matters to your business. Our pay per appointment model delivers substantial advantages compared to traditional lead generation approaches, and I’ve got the data to prove it.

Financial Benefits:

- Eliminated Prospecting Costs: Our brokers typically save NZ$2,000-5,000 monthly in marketing expenses by outsourcing lead generation. Think about what you could do with that budget elsewhere in your business.

- Improved ROI: With qualified appointments converting at 25-40% versus 5% for standard leads, you’ll realize significantly higher return on investment. One broker I work with saw his conversion rate jump from 8% to 32% within the first month – that’s a 4x improvement!

- Predictable Acquisition Costs: Fixed per-appointment pricing allows precise calculation of client acquisition costs. No more guessing games with your marketing budget.

Operational Advantages:

- Focus on Expertise: You can concentrate on advising clients rather than spending time qualifying prospects. After all, isn’t that why you got into this business in the first place?

- Increased Productivity: Appointment-only meetings maximize productive selling time. No more wasted hours with prospects who aren’t serious.

- Higher Close Rates: Pre-qualified appointments result in substantially higher conversion percentages. More policies written with the same amount of effort – who doesn’t want that?

This model works particularly well for health insurance because of the product’s complexity and the importance of face-to-face consultation in explaining coverage options. By meeting only with qualified prospects who understand the value of private health insurance, you can focus on matching specific policy features to customer needs rather than explaining basic concepts from scratch.

Our clients typically report a 30-45% reduction in client acquisition costs within three months of implementing our pay per appointment service. This efficiency stems from eliminating wasted effort on unqualified prospects and focusing exclusively on high-potential opportunities.

I remember one broker in Sydney (let’s call him Mark) who was skeptical about our service initially. He’d been burned by lead generation companies before – haven’t we all? After three months with us, he called to say he’d doubled his policy sales while actually spending less time in meetings. The difference? Every appointment was with someone genuinely interested in buying.

Types of Health Insurance Leads We Provide

We understand that different brokers specialize in different areas of health insurance. That’s why we’ve developed a sophisticated segmentation approach that delivers precisely the types of prospects you want to meet.

By Coverage Type

- Hospital Cover Appointments: These prospects are specifically seeking private hospital treatment for surgeries and procedures. They’re typically motivated by public system wait times and want the security of knowing they can get treatment when they need it.

- Extras/Ancillary Cover Appointments: Looking for dental, optical, physiotherapy and other supplementary services, these prospects are often younger and focused on day-to-day healthcare benefits.

- Combined Coverage Appointments: Wanting comprehensive protection with both hospital and extras benefits, these tend to be your premium prospects with higher policy values.

By Demographic Segment

- Young Professional Appointments: Career-focused individuals seeking privacy and convenience – they value time and often have the income to support quality coverage.

- Family Coverage Appointments: Parents concerned about timely care for children and comprehensive family protection – they’re thinking about everything from pregnancy to braces to sports injuries.

- Pre-Retiree Appointments: Adults 50+ preparing for increased healthcare needs during retirement years – they’re planning ahead and often have specific health concerns in mind.

- Business Owner Appointments: Entrepreneurs seeking coverage for themselves and potential employee benefits – they’re thinking both personally and strategically.

By Special Interest

- Elective Surgery Focus: Prospects with known future surgical needs seeking to avoid public waiting lists – they have specific procedures in mind and are highly motivated.

- Chronic Condition Management: Individuals with ongoing health concerns requiring regular specialist care – they understand the value proposition clearly.

- Dental/Optical Emphasis: Prospects specifically concerned about these high-frequency ancillary services – often good entry-level clients.

- Mental Health Coverage: Individuals seeking enhanced mental health benefits beyond public provisions – an increasingly important segment.

Each lead type undergoes customized qualification to ensure prospects match your specific target criteria. We can further refine targeting by income threshold, geographic location, and previous insurance history to deliver precisely matched appointments.

What’s your specialty? We can tailor our approach to deliver exactly the type of prospects you’re looking for – just let us know what works best for your business model.

Partner with Us for Targeted Health Insurance Lead Generation

Growing your health insurance client base shouldn’t mean compromising on prospect quality or stretching your resources thin on marketing activities that may or may not deliver results. Our specialized appointment setting service connects you directly with pre-qualified prospects actively seeking private health coverage in New Zealand and Australia.

By focusing exclusively on motivated, financially qualified individuals and families, we eliminate the waste associated with traditional lead generation methods. You’ll never again have to sort through dozens of unqualified leads to find the few worth pursuing.

AiSearch.Marketing understand the unique challenges of selling health insurance in these markets – the objections, the confusion about public vs. private coverage, the price sensitivity. That’s why we’ve developed a proven qualification process that identifies genuine prospects ready to discuss coverage options. Our local team ensures all appointments meet strict quality standards before scheduling, saving you valuable time and resources.

Experience the difference that quality appointments make to your conversion rates and business growth. With our pay per appointment model, you only invest in meetings with genuine prospects, eliminating risk while maximizing your closing opportunities.

Take the first step:

- Contact us today to discuss your specific requirements

- We’ll develop a custom targeting strategy based on your expertise

- Start receiving qualified appointments within days

- Only pay for appointments that meet our quality standards

- Watch your conversion rates and policy sales increase

Whether you specialize in comprehensive family coverage, tailored plans for specific demographics, or specialized health insurance products, we deliver qualified appointments matched to your expertise.

Get started with our risk-free service and join the growing number of successful health insurance brokers and advisors who have transformed their businesses through quality appointments. Your next valued client is just one appointment away.

Get Qualified Health Insurance Appointments Today

Contact our team to learn how our pay per appointment model can transform your health insurance business.