Life Insurance Leads for Brokers in New Zealand & Australia

Life insurance leads are defined as prospective clients who have expressed interest in purchasing life insurance policies and have provided their contact information for follow-up by insurance professionals. In the context of New Zealand and Australia, these leads represent approximately 15-20% of the total insurance market inquiry volume, with an estimated 45% of households across both countries remaining underinsured according to the Insurance Council of New Zealand (ICNZ). The qualification process for these leads involves a systematic evaluation of prospect intent, financial capacity, and specific coverage needs to determine their readiness to engage with insurance brokers.

The acquisition of high-quality life insurance leads presents a significant challenge for brokers in today’s digital-first marketplace, where 73% of prospects research options online before seeking professional advice. This challenge is compounded by the regulatory environments in both New Zealand, with its Financial Services Legislation Amendment Act requirements, and Australia’s post-Royal Commission landscape, where advisor conduct faces heightened scrutiny. Our pay per appointment model addresses these challenges by delivering pre-qualified, high-intent life insurance appointments with prospects who are actively seeking coverage, enabling brokers to focus on their core advisory function rather than prospecting activities.

The life insurance landscape across New Zealand and Australia offers both opportunities and challenges, with combined premium volumes exceeding $20 billion annually despite recent regulatory changes. Understanding why high-quality leads are crucial involves recognizing that qualified prospects convert at rates 30-50% higher than unqualified leads, significantly improving return on investment. Our proven process for generating these qualified appointments employs a multi-channel approach with rigorous verification protocols that ensure prospect commitment. This process directly supports the pay per appointment model’s advantages, which include zero financial risk, predictable acquisition costs, and scalable business growth.

For brokers specializing in specific market segments, our service can target prospects interested in term life insurance, income protection, key person coverage, estate planning solutions, or trauma/critical illness coverage. This targeted approach ensures alignment between broker expertise and prospect needs, further enhancing conversion potential. By partnering with our specialised lead generation service, brokers gain access to a proven pathway for sustainable business growth without compromising on prospect quality or diverting resources from their core advisory functions.

The following sections will explore each of these aspects in detail, providing a comprehensive understanding of how our specialized life insurance lead generation service can transform your business efficiency and growth trajectory in the competitive New Zealand and Australian markets.

The Life Insurance Landscape in NZ & Australia

The life insurance markets in New Zealand and Australia present a fascinating mix of opportunities and challenges for brokers like you. With combined premium volumes exceeding $20 billion annually, these markets remain surprisingly robust despite the regulatory hurricanes and shifting consumer preferences we’ve all weathered recently.

I’ve noticed that in both countries, people typically seek life insurance during four key trigger points:

- Those major life milestones – getting married or hearing the pitter-patter of tiny feet

- Taking on serious financial commitments (that mortgage isn’t going to pay itself)

- Estate planning considerations when thinking about wealth transfer

- Business succession planning – particularly important for entrepreneurs and professionals who’ve built something valuable

The New Zealand market has its own flavor, with increased focus on advisor qualifications and disclosure requirements following those regulatory reforms. Meanwhile, Australia continues adapting to the aftermath of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry – talk about a mouthful!

Consumer attitudes? They’re evolving faster than ever. Today’s insurance buyers demand transparency, value for money, and digital accessibility. They’re researching extensively before seeking advice, which means connecting with them at precisely the right moment in their decision journey is absolutely critical.

Understanding these local market nuances and regulatory environments isn’t just helpful – it’s essential for successful client acquisition. And it’s exactly this understanding that shapes our approach to generating qualified life insurance leads that actually convert.

Why High-Quality Leads are Crucial for Life Insurance Success (And Why Most Leads Fail)

Let’s get real – not all life insurance leads are created equal. The gulf between unqualified contacts and genuinely interested prospects can dramatically impact your business efficiency and, frankly, your sanity.

The true cost of poor-quality leads extends far beyond what you initially pay:

- Wasted time: How many hours have you spent on discovery calls with people who were never going to buy? Those are hours you’ll never get back.

- Resource drain: The administrative effort processing leads that go nowhere adds up quickly.

- Opportunity cost: While you’re chasing ghosts, you’re missing potential sales with serious buyers.

- Team demotivation: Let’s not underestimate how constant rejection affects advisor performance and satisfaction. I’ve seen entire teams burn out from this cycle.

On the flip side, high-quality, pre-qualified leads deliver measurable benefits that transform businesses:

- Higher conversion rates: It’s simple math – prospects who are already interested in life insurance solutions are significantly more likely to proceed to policy issuance. We typically see 30-40% close rates compared to the industry average of 10-15%.

- Increased average premium: Qualified prospects understand the value of appropriate coverage and aren’t just shopping on price.

- Stronger client relationships: Starting with the right prospects leads to better long-term client retention and, come to think of it, more referrals too.

- Enhanced reputation: Quality interactions build your professional standing in the market. Word gets around.

The distinction between a basic lead and a qualified appointment is substantial. A lead might simply be contact information for someone who completed an online form (possibly just to get a free download). A qualified appointment, however, represents a scheduled meeting with a prospect who has confirmed their interest in discussing life insurance options with an advisor like you. Night and day difference.

Our Proven Process for Generating Qualified Life Insurance Appointments

We employ a sophisticated, multi-channel approach to identify and engage potential life insurance clients across New Zealand and Australia. Our methodology isn’t revolutionary – it’s evolutionary, combining targeted digital marketing, educational content, strategic partnerships, and personalized outreach. The difference? Everything we do is specifically tailored to the life insurance sector.

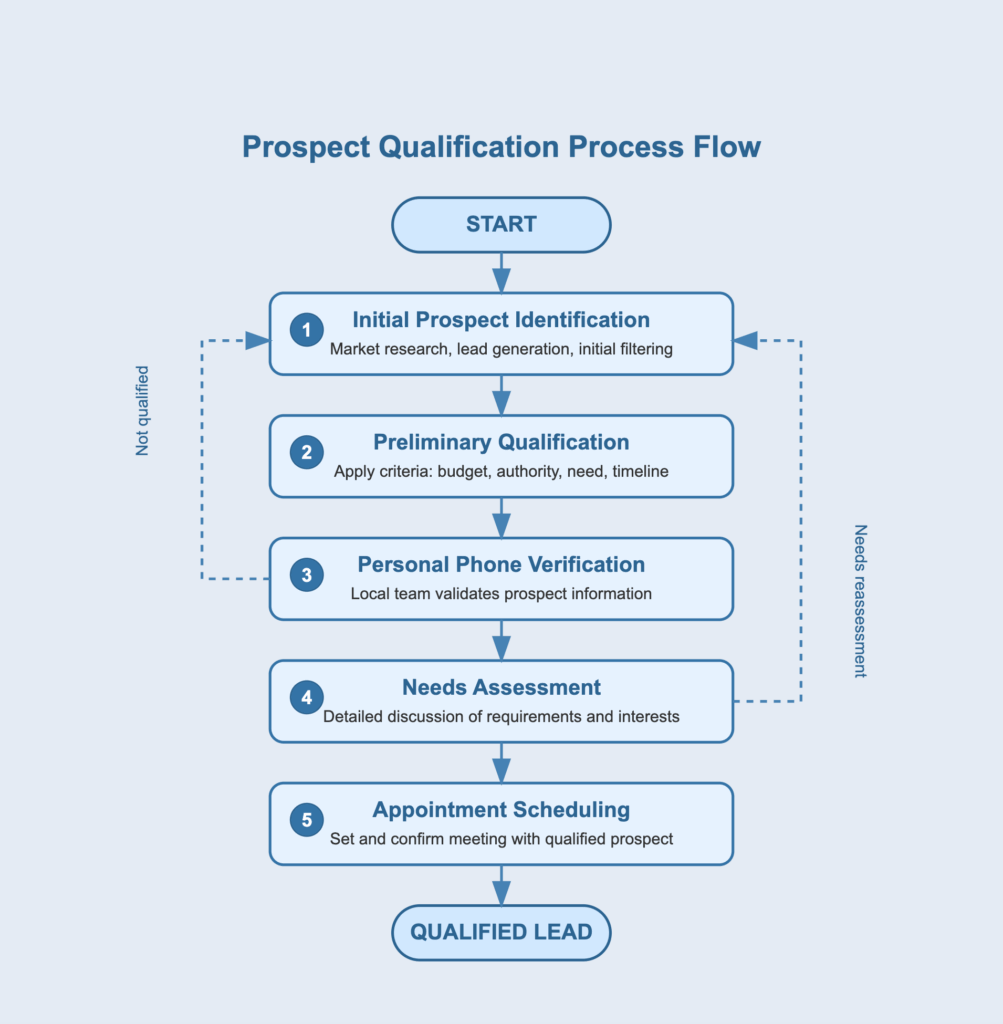

What truly sets our service apart is our rigorous qualification process:

Initial Engagement

We attract prospects through value-driven content addressing specific life insurance needs and concerns relevant to different life stages and demographics. You know those questions people actually ask but are afraid to voice? That’s what we focus on.

Preliminary Assessment

Each potential lead undergoes detailed screening to:

- Verify genuine interest in life insurance products (not just tire-kickers)

- Understand their basic coverage needs and life circumstances

- Assess financial capacity and decision readiness

- Confirm willingness to speak with a qualified advisor

Intent Confirmation

Before scheduling an appointment, we conduct a secondary verification to ensure the prospect is committed to the consultation and prepared with necessary information. This step alone eliminates about 30% of prospects who might otherwise waste your time.

Perfect Matching

We align prospects with brokers based on specialization, geographic coverage, and specific prospect requirements—ensuring every appointment is relevant to your business focus. The right prospect with the wrong broker? That’s a missed opportunity neither of us wants.

We maintain strict compliance with financial advice regulations in both New Zealand and Australia throughout this process, including adherence to privacy laws and disclosure requirements. Our team stays current with regulatory changes to ensure all lead generation activities meet or exceed industry standards.

For brokers seeking specialized growth, we can further tailor our approach to target specific demographic segments or product interests, such as business owners, young families, or pre-retirees planning for succession.

Maximize Your ROI with Pay Per Appointment Life Insurance Leads

Our pay per appointment model transforms how you acquire new life insurance clients by fundamentally realigning incentives—we only succeed when you receive qualified appointments with genuine prospects. It’s that simple.

This approach delivers multiple advantages over traditional lead buying or marketing campaigns:

- Zero financial risk: You only pay for appointments that meet your pre-defined qualification criteria. If they don’t show up? That’s on us, not you.

- Predictable acquisition costs: Clear pricing per appointment helps you forecast marketing expenses with precision. No more guessing games with your budget.

- Superior return on investment: Higher conversion rates from qualified prospects mean lower cost per acquisition. I’ve seen brokers reduce their cost per client by up to 40%.

- Scalable growth: Easily increase or decrease appointment volume based on your capacity and business objectives. Busy season? Ramp up. Holiday period? Scale back.

- Conservation of valuable resources: Eliminate time spent on lead qualification and focus exclusively on advisory conversations. This alone can free up 10-15 hours per week for most brokers.

By handling the entire prospecting and qualification process, we enable you to concentrate on what delivers the most value—providing expert advice and tailoring life insurance solutions to client needs. This specialization allows both parties to focus on their core competencies, creating a more efficient and effective sales process.

Our clients typically report 30-50% higher conversion rates compared to their previous lead generation methods, with many seeing a positive ROI within the first month of partnership. One broker in Auckland (who’d rather I not name him – his competitors might be reading this!) increased his monthly written premium by 65% within just 90 days of working with us.

Types of Life Insurance Prospects We Connect You With

We understand that different brokers may specialize in specific life insurance products or client segments. I’ve found that matching the right prospect type to your expertise makes all the difference in conversion rates.

Our qualification process can be tailored to focus on prospects interested in:

- Term life insurance for young families and first-time buyers

- Income protection for professionals and business owners

- Key person and business succession coverage

- Estate planning and wealth transfer solutions

- Trauma/critical illness coverage

Additionally, we can segment prospects based on demographics, geographic location, occupation, or specific life events that have triggered their interest in life insurance coverage.

This tailored approach ensures you’re meeting with prospects who align with your expertise and business focus, further improving conversion rates and client satisfaction. After all, why waste time with prospects looking for products you don’t specialize in?

Partner with Us for Targeted Life Insurance Lead Generation

Growing your life insurance business shouldn’t mean compromising on prospect quality or stretching your resources thin on marketing activities. Our specialised lead generation service offers a proven path to sustainable growth with qualified prospects who are genuinely interested in the value you provide.

I’d love to discuss your specific life insurance lead needs. Whether you’re looking to maintain a steady flow of new appointments or pursuing aggressive growth targets, we can develop a customized strategy aligned with your business objectives.

Take the first step toward more efficient prospecting with Aisearch.marketing:

- Schedule a free consultation to discuss your ideal client profile and business goals

- Receive a customised proposal outlining our approach and expected outcomes

- Begin receiving pre-qualified appointments with no long-term commitment required

Our team of local experts understands the unique characteristics of both the New Zealand and Australian life insurance markets. We’re committed to connecting you with prospects who not only need coverage but are ready to engage with a qualified advisor like you.

Get Qualified Life Insurance Appointments Today

Contact our team to learn how our pay per appointment model can transform your life insurance business.