Our Insurance Lead Qualification Process

In the fast-paced world of insurance, we know your time is gold. Every minute spent chasing down a lead that goes nowhere is a minute you could have spent closing a deal with someone genuinely ready to protect their future. It’s a frustrating reality – industry research even suggests brokers can lose 15-20 hours every month on leads that weren’t properly qualified. That translates to thousands in lost potential revenue each year.

Here’s our core belief: quality beats quantity, hands down. Our philosophy isn’t just talk; it’s built into everything we do. We’re committed to delivering only meticulously vetted, call-verified appointments. These aren’t just names on a list; they’re real people, genuinely interested in the insurance solutions you offer and ready to have a meaningful conversation.

Why So Many Insurance Leads Miss the Mark

Let’s be frank: the traditional lead generation landscape often feels like navigating a minefield. Understanding why so many leads fall short is key to appreciating the value we bring with our rigorous qualification process.

The Industry-Wide Quality Conundrum

The numbers are pretty sobering. Recent data shows average conversion rates for standard insurance leads stuck around a dismal 2-5%. That means for every 100 leads purchased, maybe 2 to 5 actually turn into policies. Why such poor performance? Several factors are at play:

- Dodgy Data: It’s shocking, but studies show up to 25% of standard lead data has errors – wrong phone numbers, incorrect emails. How can you follow up if you can’t even reach them?

- Fake Interest: Many leads come from contests, quizzes, or misleading opt-ins that have zero connection to actual insurance needs. The intent just isn’t there.

- Broker Overload: Ever feel like you’re the fifth broker calling the same person? It happens. Around 67% of leads report being contacted by multiple brokers, leading to frustration and immediate resistance.

- Financial Mismatch: Research indicates a significant chunk (around 40%) of insurance leads simply don’t have the financial means to purchase the coverage they inquired about.

The Hidden Costs That Bleed You Dry

The sticker price of a lead is just the tip of the iceberg. The real costs are hidden, and they hurt:

- The Time Sink: For every hour wasted on a bad lead, you lose 2-3 hours of productive selling time. It’s a massive drain.

- Opportunity Knocks (and You Miss It): Every minute spent chasing a dead end is a minute you didn’t spend talking to a qualified prospect ready to buy.

- Team Morale Killer: Nothing burns out a sales team faster than constantly hitting dead ends. Productivity can plummet by up to 30% when lead quality is consistently poor.

- Brand Damage: Reaching out to people who didn’t genuinely ask for insurance info can tarnish your hard-earned reputation.

Insurance isn’t simple. People often have complex needs across different categories and varying levels of understanding. A generic lead just doesn’t cut it.

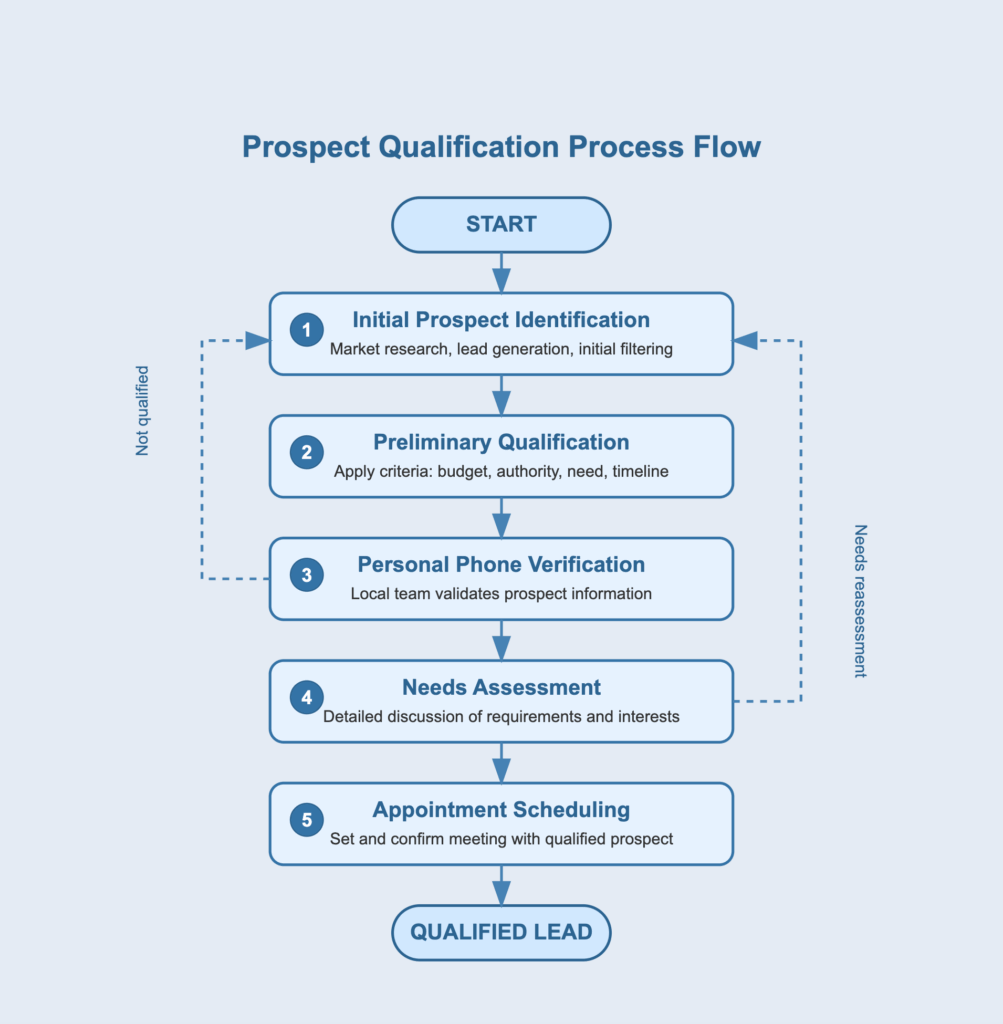

Our 5-Step Qualification Methodology: Where Quality is Forged

What truly sets our service apart is our comprehensive, human-centric qualification process. We don’t just rely on algorithms; we blend sophisticated technology with essential personal verification to guarantee exceptional appointment quality.

1. Initial Prospect Identification and Smart Filtering

It all starts with finding the right people – those most likely to need your specific insurance offerings:

- We analyze online behavior to spot genuine insurance research patterns.

- Demographic matching ensures prospects fit your ideal client profile.

- Our systems differentiate between casual browsers and serious researchers by analyzing intent signals.

- We perform initial data checks to weed out obvious inaccuracies.

- Proprietary algorithms filter out leads showing historical low-quality indicators.

Right off the bat, this intelligent filtering typically eliminates about 60% of potential prospects, letting us focus our energy where it counts.

2. Applying Your Custom Qualification Criteria

Next, we layer on your specific requirements:

- Geographic Targeting: We ensure prospects are located within your licensed service areas.

- Financial Thresholds: We apply minimum financial criteria based on your target market.

- Insurance Category Alignment: We confirm their interest matches the products you specialize in.

- Timeline Assessment: We gauge their urgency and readiness to talk seriously.

- Current Coverage Review: We look for genuine opportunities where switching makes sense.

This systematic step typically filters out another 40-50% of the remaining pool, leaving only high-potential individuals.

3. Personal Phone Verification by Our Local Team (The Game Changer!)

This is the heart of our process and where we truly shine. Our dedicated New Zealand and Australian call teams personally connect with prospects:

- Our specialists are local, understanding regional nuances and building rapport naturally.

- They conduct calls in a helpful, consultative manner – no high-pressure sales tactics.

- Extensive training ensures they understand insurance concepts and assess quality consistently.

- They engage in real conversations, listening for cues and assessing genuine interest.

- They evaluate the prospect’s communication style and engagement level.

It’s fascinating – this human verification step often weeds out another 30-40% of prospects who looked good on paper (or screen!) but just don’t demonstrate genuine intent or qualification during a real conversation. For instance, someone might click on ‘business insurance’ but reveal on the call they’re just vaguely thinking about starting a side hustle ‘someday’. Our team identifies that mismatch, saving you the wasted appointment.

4. Needs Assessment and Genuine Interest Confirmation

During these verification calls, our team doesn’t just tick boxes; they conduct a thoughtful assessment (without being intrusive):

- They sensitively explore the prospect’s current insurance situation.

- They identify specific pain points or needs driving their interest.

- They delicately confirm budget expectations align with typical product costs.

- They verify the person they’re speaking with has the authority to make decisions.

- They note any competing options the prospect might be considering.

- They establish a realistic timeline for when the prospect aims to make a decision.

This deeper understanding provides invaluable context for your appointment and confirms the prospect is truly ready to engage.

5. Smart Appointment Scheduling and Confirmation

Finally, we ensure only fully-baked, qualified prospects land on your calendar, ready for a productive meeting:

- We schedule appointments at mutually convenient times.

- We set clear expectations about the appointment’s purpose and format.

- We send digital calendar invites with reminders and ensure they’re accepted.

- We share pre-appointment materials if appropriate, priming the prospect.

- Our day-before courtesy reminders significantly minimize no-shows.

- A final quality audit confirms all criteria were met before finalizing.

Our verification specialists keep detailed notes throughout, giving you a valuable head-start before you even pick up the phone or log into the video call.

The Quality Criteria We Live By

Consistency is key. We evaluate every single prospect against tough criteria designed specifically for the nuances of insurance sales:

Genuine Interest in Insurance Products

We look beyond simple clicks for real intent signals:

- Recent life events (buying a home, starting a business, having a baby)?

- Asking specific questions about coverage options?

- Expressing a clear timeline for making decisions?

- Mentioning upcoming policy renewals?

- Voicing dissatisfaction with their current provider?

Financial Capability to Purchase

We qualify finances respectfully but realistically:

- Does their income align with the typical cost of the insurance type?

- Does their current premium spend indicate capacity?

- Are relevant assets validated (for property/asset insurance)?

- Is business revenue assessed (for commercial lines)?

- Is an available budget explicitly confirmed during the call?

Decision-Making Authority

We make sure you’re talking to the right person:

- Do they have direct authority to purchase?

- What’s their role in household or business financial decisions?

- Are other stakeholders involved who need to be present?

- What are the approval processes for business insurance?

- Can we align schedules if multiple decision-makers are needed?

Timeframe for Decision

Understanding urgency is critical:

- Are there current policy expiration dates looming?

- Are there critical deadlines (property settlements, business launches)?

- What are their expressed timeline preferences?

- Are there competing priorities that might delay a decision?

- Are their timeframe expectations realistic?

Specific Insurance Needs Alignment

We ensure a perfect match between their needs and your expertise:

- Do we have a detailed understanding of their coverage requirements?

- What specific insurance types and coverage levels are they considering?

- What’s their risk profile relevant to the insurance category?

- Are there special circumstances needing particular expertise?

- Do they have complex needs spanning multiple insurance types?

Customized Qualification by Insurance Type

We don’t use a one-size-fits-all approach. Our criteria adapt:

- Life Insurance: We consider family situation, existing cover, health factors, financial protection goals.

- Health Insurance: We look at current status, specific health concerns, budget, coverage priorities.

- Income Protection: We assess employment status, income stability, existing protection, risk appetite.

- Property Insurance: We verify asset details, current coverage, risk factors, value.

Each prospect gets a proprietary quality score. Only those hitting our minimum threshold (typically 85/100) make it onto your calendar.

The Call Verification Difference Why Humans Matter

That personal phone verification? It’s not just a step; it’s the cornerstone of our quality promise.

The Human Element in Quality Assessment

Our specialists bring skills no algorithm can replicate:

- Nuance Detection: They pick up on subtle conversational cues that signal genuine (or lacking) interest.

- Rapport Building: They can address initial questions or concerns, creating a positive first interaction.

- Cultural Sensitivity: They understand the local market nuances in New Zealand and Australia.

- Brand Ambassadorship: They engage authentically, reflecting positively on your brand from the first touchpoint.

- Intuitive Red Flag Spotting: Experience helps them sense when something isn’t quite right based on conversation flow.

Our Local Team Advantage

Our verification team members are:

- Local Experts: Based right here in NZ and Australia, understanding the market inside-out.

- Insurance Savvy: Extensively trained in insurance concepts and terminology.

- Consultative Communicators: Skilled in guiding conversations, not just reading scripts.

- Quality Focused: Experts in assessing genuine qualification, not just ticking boxes.

- Professional Representatives: Committed to upholding your brand’s reputation.

Our Conversation Approach and Spotting Red Flags

Our calls are structured for insight, not pressure:

- Consultative, Not Salesy: We aim to understand, not to sell.

- Open-Ended Questions: Encouraging prospects to share their real situation and intent.

- Active Listening: Truly hearing their needs and concerns.

- Trust-Building: Using non-intrusive questioning to gather necessary information respectfully.

During these calls, our team is vigilant for red flags:

- Hesitation to share basic qualifying info?

- Inconsistent answers?

- Fixation on price before understanding value?

- Unwillingness to commit to a timeframe?

- Vague responses about decision-making?

When these signs appear, the prospect is respectfully disqualified. This rigorous filtering ensures only high-intent, genuinely qualified appointments reach you.

Quality Assurance and Continuous Improvement: We Never Stop Refining

Our commitment doesn’t end once an appointment is booked. We have robust systems to maintain and enhance quality constantly:

Ongoing Monitoring Process

We keep a close eye on quality through:

- Regular auditing of verification calls by QA specialists.

- Tracking performance metrics for each verification team member.

- Analyzing conversion patterns by lead source and verifier.

- Correlating appointment outcomes with initial qualification data.

- Holding regular calibration sessions to ensure consistent standards.

Feedback Integration System

Your experience drives our improvement:

- We collect structured feedback from you after appointments.

- We conduct 30-day performance reviews analyzing conversion data.

- We optimize our processes quarterly based on real-world outcomes.

- We refine qualification criteria based on market shifts.

- We update team training with emerging best practices.

Our Quality Measurement Framework

We track the metrics that matter:

- Appointment Show Rate: Consistently averaging an impressive 92%.

- Prospect-to-Quote Ratio: Currently hitting 85% – meaning most appointments lead to a quote.

- Quote-to-Close Ratio: Tracked by insurance type to identify trends.

- Broker Satisfaction: Your feedback is a key performance indicator.

- Time-to-Conversion: Measuring efficiency from appointment to policy.

This data-driven approach ensures our qualification process stays sharp, effective, and aligned with your needs.

Experience the Quality Difference, Stop Chasing, Start Closing

The impact of switching from standard leads to our call-verified appointments is genuinely transformative. Our clients consistently report:

- Sky-High Show Rates: 92% on average, compared to the 50-60% industry norm.

- Dramatically Higher Conversions: Often 3-4 times better than with traditional leads.

- Significant Time Savings: Reclaiming those 15-20 hours previously lost each month.

- Increased Average Premiums: Higher quality prospects often lead to larger policies.

- Enhanced Reputation: Meeting only with people who genuinely want to talk to you.

We stand firmly behind our process. That’s why we offer a straightforward guarantee: if any appointment somehow slips through and doesn’t meet our strict quality standards, we’ll replace it, no questions asked, at no additional cost.

Ready to Take the Next Step?

Isn’t it time you experienced the difference truly qualified appointments can make? Try our risk-free trial:

- Schedule a Consultation: Let’s discuss your specific criteria and ideal client profile.

- Receive Your First Appointments: Get your first three call-verified appointments delivered to your calendar.

- Evaluate the Quality: Experience the difference firsthand – we’re confident you’ll be impressed.