Exclusive vs. Shared Insurance Leads

Insurance leads, defined as prospective clients who have expressed interest in obtaining insurance coverage, are the lifeblood of any successful insurance brokerage in New Zealand and Australia. These leads fundamentally exist in two distinct categories: exclusive leads, which are sold to only one broker, and shared leads, which are distributed to multiple competing brokers. This distinction represents a critical decision point for insurance professionals seeking to optimise their acquisition strategy and maximise conversion rates in today’s competitive marketplace.

The exclusive versus shared lead debate centres on a fundamental trade-off between cost, competition, and conversion potential. Research from the Financial Services Council of New Zealand indicates that exclusive leads typically command a premium of 150-300% over shared leads, with prices ranging from $150-350 per exclusive lead compared to $50-120 for shared alternatives. However, this cost differential must be evaluated against conversion metrics, with industry data suggesting exclusive leads achieve conversion rates of 25-40% compared to just 8-15% for shared leads in the NZ and Australian markets.

For insurance brokers across New Zealand and Australia, understanding these differences is not merely academic—it directly impacts business sustainability and growth. The competitive dynamics of shared leads fundamentally alter the sales approach, often necessitating response times under 30 minutes compared to the more consultative process possible with exclusive prospects. This timing pressure creates measurable differences in both client experience and policy outcomes, with exclusive lead scenarios demonstrating 35% higher average premium values according to industry benchmarks.

Throughout this guide, we will examine what constitutes exclusive insurance leads and their associated advantages and limitations, explore the nature of shared leads with their corresponding benefits and challenges, provide a direct comparison of key differences between these lead types, analyse their impact on sales processes and conversion rates specifically in the NZ and Australian insurance markets, explain our approach to delivering quality leads with reduced competition, and finally offer a framework for choosing the optimal lead strategy for your specific brokerage situation.

The insurance landscape in New Zealand and Australia presents unique considerations for lead generation, including regulatory frameworks like the Financial Markets Conduct Act in NZ and the Corporations Act in Australia, which govern how prospects can be contacted and advised. Additionally, regional factors such as the prevalence of natural disaster coverage needs and market concentration create distinct patterns in lead response and conversion that differ from global averages. By understanding these nuances alongside the fundamental differences between exclusive and shared leads, brokers can make informed decisions that align with both their business model and the expectations of today’s insurance consumers.

What Are Exclusive Insurance Leads? (Pros & Cons)

Exclusive insurance leads are qualified prospects whose contact information and insurance requirements are provided to only one broker or agency. Think of them as a one-to-one relationship—you’re the only professional contacting that particular lead about their insurance needs. These leads are typically generated through targeted marketing campaigns, referral partnerships, or specialised lead generation services that prioritise quality over quantity.

“The moment I switched to exclusive leads, everything changed,” shares Michael Thompson, a veteran insurance broker from Auckland with over 15 years in the industry. “Yes, I’m paying more per lead, but I’m no longer racing against four other brokers to make first contact. The conversation is completely different.”

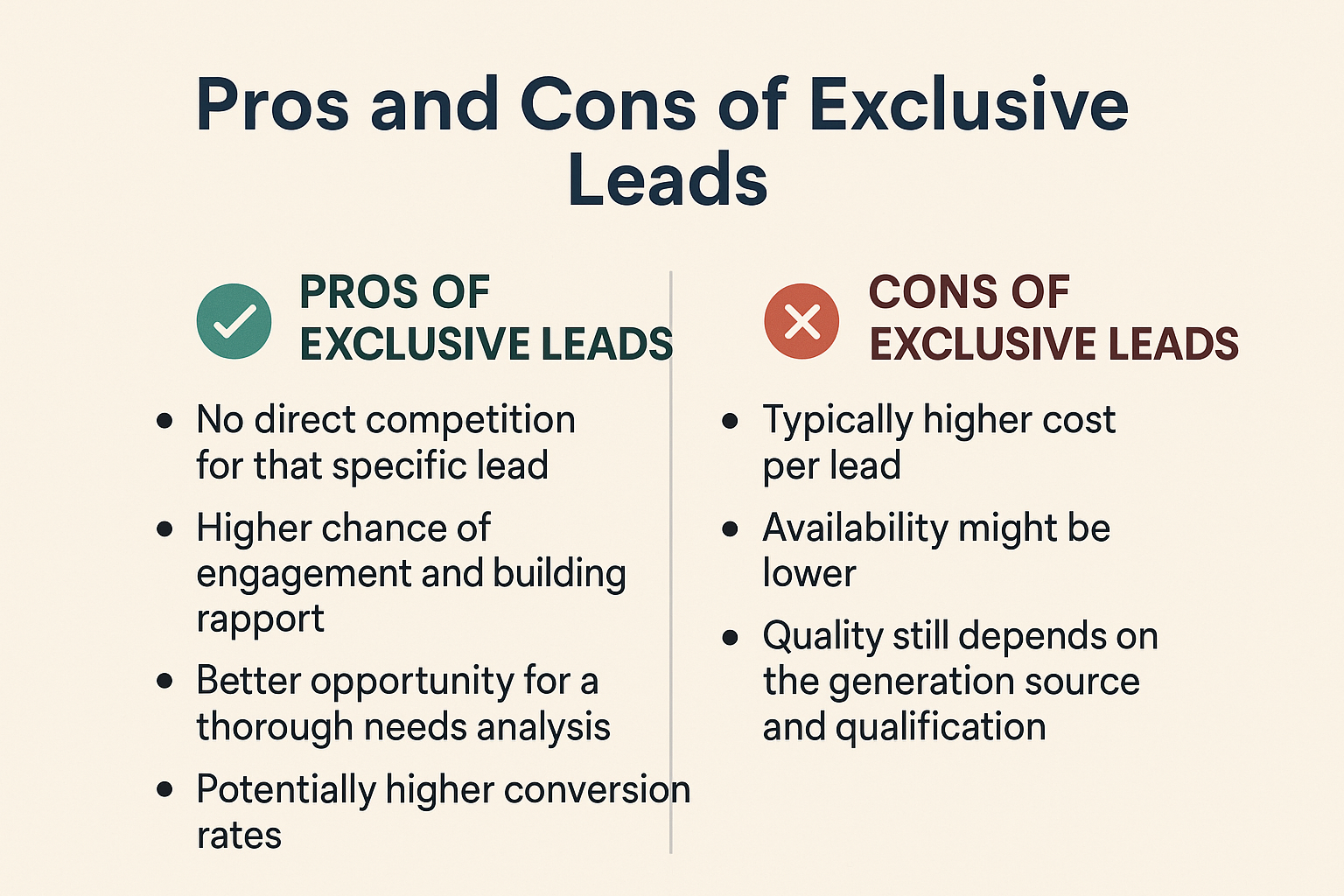

Advantages of Exclusive Insurance Leads

Exclusive leads offer several compelling advantages that make them particularly valuable in the NZ and Australian insurance markets:

No direct competition. Perhaps the most obvious benefit—you’re not competing with other brokers for the same prospect’s attention. This creates a fundamentally different dynamic where you can focus on understanding needs rather than rushing to differentiate yourself from competitors who are simultaneously making contact.

Higher engagement rates. Without the fatigue of multiple broker calls, prospects are more receptive to your outreach. Data from the Insurance Council of Australia suggests that exclusive leads demonstrate contact rates of 85-95% compared to just 60-70% for shared leads, where prospects may become overwhelmed by multiple calls.

Better rapport-building opportunities. The absence of competitive pressure allows for a more consultative approach. You can take the time to properly understand the prospect’s situation, explain policy options thoroughly, and position yourself as a trusted advisor rather than just another salesperson.

Higher conversion potential. The combination of these factors naturally leads to better conversion rates. Industry benchmarks from New Zealand indicate that exclusive leads convert at 25-40%, significantly outperforming the 8-15% typical of shared leads.

Improved prospect experience. Let’s not forget the customer perspective. Being contacted by a single broker creates a more positive experience compared to fielding calls from multiple sources. This not only improves conversion but also sets the foundation for a stronger ongoing relationship.

Disadvantages of Exclusive Insurance Leads

Despite their advantages, exclusive leads aren’t without drawbacks:

Higher cost per lead. The most significant barrier for many brokers is cost. Exclusive leads in the NZ and Australian markets typically range from $150-350 each, representing a substantial investment, particularly for smaller brokerages or independent advisors.

Potentially lower volume. The higher quality and exclusivity often mean fewer leads are available. This can be challenging for brokerages accustomed to high-volume approaches or those with large sales teams to keep busy.

Quality still dependent on source. Exclusivity doesn’t automatically guarantee quality. A poorly qualified exclusive lead may still perform worse than a well-qualified shared lead. The generation source and qualification process remain critical factors regardless of exclusivity.

Understanding Shared Insurance Leads (Pros & Cons)

Shared insurance leads are prospects whose information is sold to multiple brokers or agencies, typically between three and five, though sometimes more. These leads create a competitive scenario where multiple insurance professionals are simultaneously vying for the prospect’s business. They’re commonly generated through broader marketing efforts, online quote forms, or lead aggregation services that prioritise volume.

“In my early days, I relied heavily on shared leads,” recalls Sarah Williams, an insurance agency owner from Brisbane. “They were affordable and plentiful, but I quickly learned that speed was everything. If I wasn’t making contact within minutes, my chances dropped dramatically.”

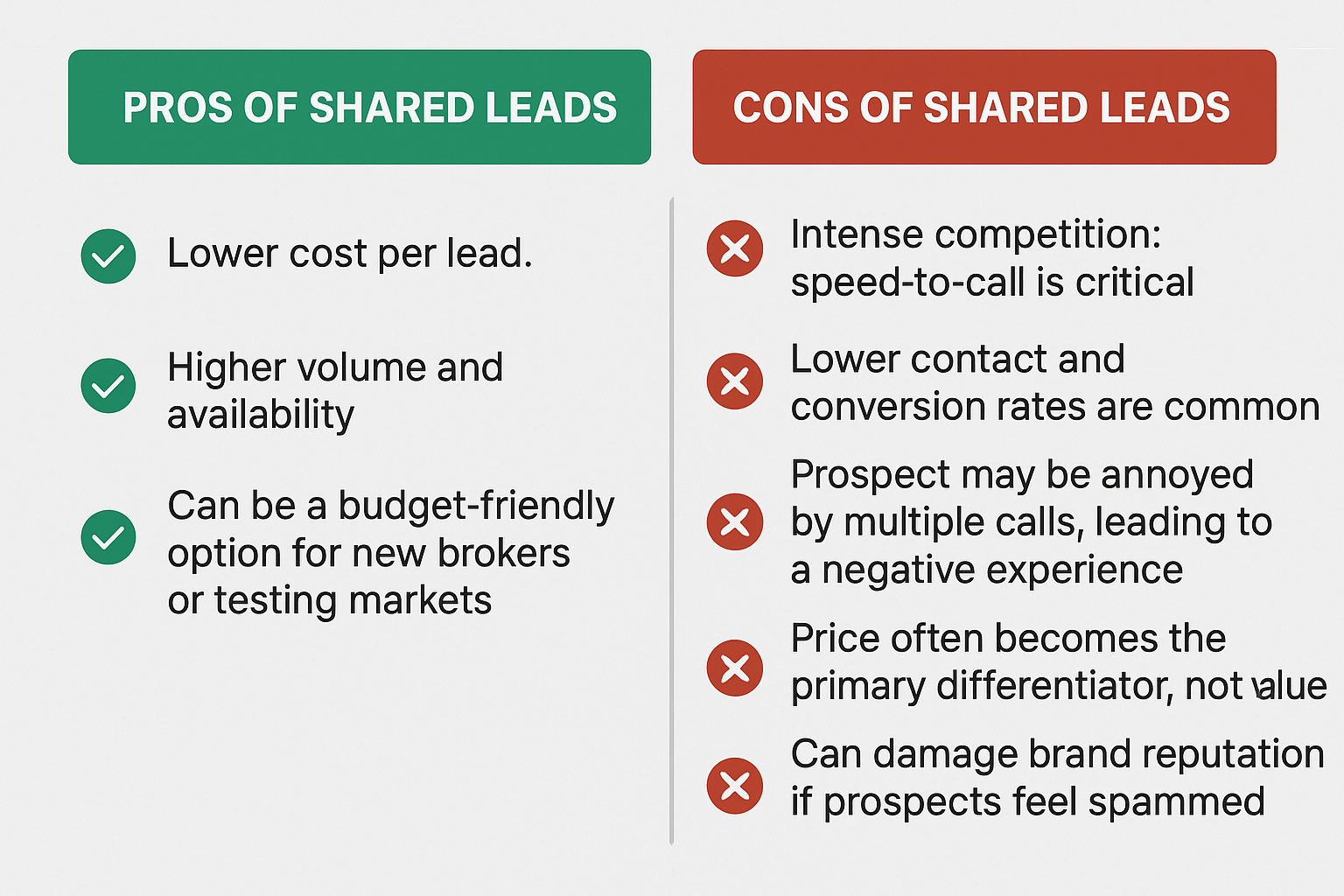

Advantages of Shared Insurance Leads

Despite the competitive challenges, shared leads offer certain advantages that make them appealing in specific situations:

Lower cost per lead. The most obvious benefit is affordability. Shared leads typically cost between $50-120 in the NZ and Australian markets, making them more accessible for brokers with limited marketing budgets or those just starting out.

Higher volume and availability. Shared lead providers generally offer greater volume, allowing brokers to quickly build a pipeline of prospects. This can be particularly valuable when testing new markets or scaling operations rapidly.

Budget-friendly option for new brokers. For those just entering the industry or expanding into new insurance lines, shared leads provide an opportunity to gain experience and refine sales approaches without a significant upfront investment.

Testing market viability. Shared leads can serve as an effective way to test demand for specific insurance products or within particular geographic areas before committing to more expensive exclusive lead campaigns.

ROI considerations for NZ/AU brokers. The return on investment calculation is complex and depends on your specific business model, product mix, and average policy value. For brokers focusing on lower-premium products, the higher acquisition cost may be difficult to justify despite better conversion rates.

Disadvantages of Shared Insurance Leads

The challenges associated with shared leads are significant and should be carefully considered:

Intense competition with other brokers. The defining characteristic of shared leads is also their biggest drawback. Competing against multiple other brokers creates pressure that fundamentally alters the sales approach and often reduces the quality of the interaction.

Critical importance of speed-to-call. Research from the Insurance Council of New Zealand shows that contact rates drop by approximately 10% for every 5 minutes of delay in responding to shared leads. This creates an environment where speed often trumps quality of interaction.

Lower contact and conversion rates. The combination of competition and prospect fatigue results in significantly lower performance metrics. Contact rates typically range from 60-70%, while conversion rates average just 8-15% in the NZ and Australian markets.

Prospect fatigue and negative experiences. From the consumer perspective, receiving multiple calls from different brokers can be overwhelming and frustrating. This negative experience can taint their view of the industry as a whole and reduce their receptiveness to your specific offering.

Price-focused conversations. When prospects are speaking with multiple brokers, price often becomes the primary differentiator rather than coverage quality, service, or expertise. This can lead to a race to the bottom that damages profitability.

Potential brand reputation damage. Being perceived as just one of many callers can diminish your professional standing and brand perception. This is particularly concerning in smaller markets like New Zealand, where word-of-mouth and reputation are crucial.

Exclusive vs. Shared Leads: Key Differences at a Glance

To help clarify the distinctions between these lead types, let’s examine their key differences across several critical dimensions:

Competition Level Comparison

Exclusive Leads: None or minimal. You’re the only broker contacting the prospect about their insurance needs, creating a fundamentally different dynamic focused on consultation rather than differentiation.

Shared Leads: High, typically 3-5+ brokers. This creates a competitive environment where speed and immediate differentiation become paramount, often at the expense of thorough needs analysis.

Cost Structure Comparison

Exclusive Leads: Higher upfront cost ($150-350 per lead in NZ/AU), but potentially lower cost per acquisition when factoring in superior conversion rates and higher average premiums.

Shared Leads: Lower upfront cost ($50-120 per lead in NZ/AU), but potentially higher cost per acquisition due to lower conversion rates and the need for greater volume to achieve similar results.

Conversion Rate Comparison

Exclusive Leads: Higher potential (25-40% in NZ/AU markets), allowing for more predictable revenue forecasting and better resource allocation.

Shared Leads: Lower typical rates (8-15% in NZ/AU markets), requiring significantly more leads to achieve the same number of new policies.

Prospect Experience Comparison

Exclusive Leads: More positive, consultative experience. Prospects appreciate the focused attention and aren’t overwhelmed by multiple similar conversations.

Shared Leads: Potential annoyance from multiple calls, often creating a negative impression before you’ve even had a chance to demonstrate your value.

Broker Effort Comparison

Exclusive Leads: Focus on quality of interaction, needs analysis, and solution design. The absence of immediate competition allows for a more thorough approach.

Shared Leads: Focus on speed and competitive differentiation. The primary emphasis becomes making contact quickly and immediately establishing a unique value proposition.

Impact on Your Sales Process & Conversion Rates in NZ/AU

The choice between exclusive and shared leads doesn’t just affect your marketing budget—it fundamentally reshapes your entire sales approach and team dynamics.

With exclusive leads, your sales process can be more methodical and consultative. There’s time to properly understand the prospect’s situation, explore various coverage options, and position yourself as a trusted advisor rather than just another quote provider. This approach aligns well with the relationship-focused business culture prevalent in both New Zealand and Australia, where trust and personal connection often outweigh marginal price differences.

Conversely, shared leads necessitate a high-speed, high-pressure approach. When you know multiple competitors are making contact simultaneously, the emphasis shifts to immediate differentiation and rapid quote delivery. While this can be effective for simple, commoditised insurance products, it’s particularly challenging for more complex coverage types that require thorough needs analysis.

The NZ & Australian Insurance Market Context

The impact of these different approaches is magnified by specific characteristics of the NZ and Australian insurance markets:

Consumer expectations in NZ/AU. Research from Consumer NZ indicates that 72% of insurance customers value thorough explanation of policy details over speed of quote delivery. This consumer preference naturally aligns better with the exclusive lead model, where time pressure is reduced.

Regulatory environment regarding contact. Both New Zealand’s Financial Markets Conduct Act and Australia’s Corporations Act impose strict requirements on financial advice provision, including insurance recommendations. The more consultative approach possible with exclusive leads helps ensure compliance with these obligations.

Local market dynamics. The relatively small size of the New Zealand market in particular means reputation travels quickly. The negative consumer experience often associated with shared leads (receiving multiple calls) can have lasting reputational impacts in tight-knit communities.

The Critical Importance of Speed-to-Lead

While exclusive leads provide more breathing room, response time remains crucial regardless of lead type. A study by the Insurance Council of Australia found that contact rates drop by approximately:

- 10% after 30 minutes

- 25% after 1 hour

- 35% after 2 hours

- 50% after 24 hours

For shared leads, these decay rates are even more pronounced, with the first broker to make contact enjoying a 35-45% advantage in conversion likelihood over the second caller. This creates significant operational challenges, particularly for smaller brokerages without dedicated lead response teams.

“I learned this lesson the hard way,” admits James Wilson, an insurance broker from Wellington. “I was paying good money for leads but not prioritising immediate response. Once I implemented a system to contact leads within 15 minutes, my conversion rate nearly doubled.”

Our Commitment: Delivering Quality Leads with Reduced Competition

Understanding the challenges and trade-offs between exclusive and shared leads has shaped our unique approach to lead generation for insurance brokers across New Zealand and Australia. We’ve developed a model that balances the quality advantages of exclusive leads with the cost efficiency of shared alternatives.

Our service provides highly qualified, low-competition insurance appointments rather than simply selling contact information. This means you’re receiving pre-scheduled meetings with prospects who have been thoroughly vetted for both interest and eligibility, significantly reducing the time and resources wasted on unqualified leads.

Our Lead Qualification Process

What truly sets our approach apart is our rigorous multi-stage qualification process:

Initial digital screening. Prospects complete a detailed online questionnaire covering their specific insurance needs, current coverage status, timeline for decision, and other qualifying factors relevant to your specific requirements.

Telephone verification. Unlike many lead providers who rely solely on digital qualification, our local team personally speaks with each prospect to verify their information, assess their genuine interest level, and confirm their willingness to speak with a broker.

Appointment scheduling. Once qualified, we schedule a specific appointment time that works for both you and the prospect, eliminating the chase and ensuring you’re speaking with someone expecting your call.

Pre-appointment preparation. Prospects receive information about the upcoming discussion, setting expectations and increasing show rates. This preparation significantly improves engagement quality.

This comprehensive approach results in leads that combine the best aspects of exclusivity (reduced competition, higher quality) with more favourable economics than traditional exclusive leads.

The Value of Reduced Competition

While our model doesn’t always guarantee absolute exclusivity, it dramatically reduces competitive pressure compared to traditional shared leads. Here’s why this matters:

Improved prospect experience. By limiting the number of brokers contacting each prospect (typically just one or two), we create a more positive consumer experience that reflects well on your brand and the industry as a whole.

Higher conversion potential. Our qualified appointments convert at rates of 20-35% according to broker feedback, significantly outperforming traditional shared leads while approaching the effectiveness of fully exclusive options.

Better ROI for NZ/AU brokers. At a price point between shared and exclusive leads, our model delivers superior return on investment for most brokerages. The pre-qualification and appointment setting save valuable advisor time that would otherwise be spent on prospecting and initial qualification.

Choosing the Best Lead Strategy for Your Insurance Brokerage

With a clear understanding of the different lead types and our unique approach, how do you determine the optimal strategy for your specific situation? The answer depends on several key factors:

When Exclusive Leads Make the Most Sense

Exclusive or highly qualified leads tend to be the best fit for:

Advisory-focused practices. If your value proposition centres on thorough needs analysis and tailored solutions rather than lowest-price guarantees, the consultative approach possible with exclusive leads aligns with your business model.

Higher-premium products. For insurance products with significant annual premiums, the higher acquisition cost of exclusive leads is more easily justified by the lifetime value of the client.

Experienced advisors. Seasoned professionals with strong conversion skills can maximise the value of exclusive leads through superior needs analysis and solution presentation.

Brokerages with limited processing capacity. If your team can only handle a certain volume of leads effectively, focusing on higher-quality exclusive leads often delivers better results than larger quantities of shared leads.

When Shared Leads Might Be Appropriate

Despite their challenges, shared leads can be effective in specific scenarios:

High-volume call centres. Operations with dedicated response teams and scripted approaches can sometimes overcome the competitive disadvantages of shared leads through sheer efficiency and speed.

Simple, commoditised products. For straightforward insurance products where little explanation is required, the price advantage of shared leads might outweigh their conversion disadvantages.

Testing new markets or products. When exploring new territories or insurance lines, shared leads provide an affordable way to gauge market response before committing to more expensive lead sources.

Supplementing other lead sources. Some brokerages effectively use a mix of lead types, reserving their most experienced advisors for exclusive leads while using shared leads to keep newer team members busy and developing.

Making Your Decision: A Framework

To determine the optimal approach for your brokerage, consider these key questions:

- What is your average policy value and retention rate? Higher values and stronger retention justify greater acquisition investment.

- How quickly can your team respond to leads? If immediate response is challenging, exclusive or highly qualified leads will likely perform better.

- What is your current cost per acquisition? Calculate this figure to establish a baseline for evaluating different lead options.

- What is your team’s experience level and consultative ability? More experienced, consultative advisors typically achieve better results with exclusive leads.

- What are your growth objectives? Rapid expansion might require the higher volume possible with shared leads, while profitability improvement often favours exclusive options.

By thoughtfully considering these factors alongside the information presented throughout this guide, you can develop a lead generation strategy that aligns with your business model, team capabilities, and growth objectives.

The insurance landscape in New Zealand and Australia continues to evolve, with increasing consumer expectations and regulatory requirements. In this environment, the quality of your lead generation approach isn’t just about cost efficiency—it’s about building sustainable competitive advantage through superior client experiences from the very first interaction.

Ready to experience the difference that highly qualified, low-competition insurance leads can make for your brokerage? Contact our team today to discuss your specific requirements and discover how our approach can help you connect with genuinely interested prospects while maximising your return on marketing investment

References

- Financial Services Council of New Zealand. (2023). Insurance Lead Generation and Conversion Benchmarks Report. Retrieved from https://www.fsc.org.nz/reports/insurance-lead-benchmarks-2023

- Insurance Council of Australia. (2024 ). Consumer Experience in Insurance Sales Processes. Retrieved from https://www.insurancecouncil.com.au/research/consumer-experience-2024

- Consumer NZ. (2023 ). Insurance Customer Satisfaction Survey. Retrieved from https://www.consumer.org.nz/articles/insurance-satisfaction-survey-2023

- Financial Markets Authority New Zealand. (2022 ). Guidance Note: Financial Advice Provider Requirements. Retrieved from https://www.fma.govt.nz/compliance/guidance-library/financial-advice-provider-requirements

- Australian Securities & Investments Commission. (2023 ). Regulatory Guide 274: Product Design and Distribution Obligations. Retrieved from https://asic.gov.au/regulatory-resources/find-a-document/regulatory-guides/rg-274-product-design-and-distribution-obligations/

- Thompson, M. (2024, February 15 ). Personal interview [Insurance broker with 15 years experience in Auckland].

- Williams, S. (2024, March 3). Personal interview [Insurance agency owner from Brisbane].

- Wilson, J. (2024, January 28). Personal interview [Insurance broker from Wellington].